Silver linings despite performance slump

There has been a marked downturn in performance across the property industry over the past half-year. Yet the winds of change may have begun to blow, offering renewed optimism for the outlook ahead.

What a difference six months makes. In October 2023, Avdiev Report’s biannual Insights Survey recorded nearly two-thirds of property companies stating that they were performing well or very well, shrugging off the risks to their operations posed by rising costs and interest rates, chronic staff shortages, and unstable international conditions.

Our most recent survey conducted in February, however, showed a marked downturn, with only 2 in 5 companies now describing their performance the same way. Most suggested they are now performing moderately – neither well nor badly. Very few said they are doing badly, while none reported performing “very badly”.

Most companies also anticipate little to no change in operating conditions for the remainder of 2024. Longer-term, however, there is scope for optimism, with several major challenges at last showing signs of abating after their stubbornly firm grip over property companies – and indeed most industries – in the years since the COVID-19 pandemic hit.

Remuneration stabilising

At a time when gender pay gap data for individual employers has just been released publicly, and wage pressures dominate headlines, remuneration is front of mind for companies.

While supply chain issues, business collapses and cost blowouts have all weighed on performance, staffing constraints in terms of remuneration and recruitment were consistently cited as among the biggest challenges.

Remuneration in the property industry increased by 4.7% (median) overall in the past six months, continuing to outpace the general workforce, which the Australian Bureau of Statistics’ December 2023 Wage Price Index pegged at 4.2%.

Perhaps unsurprisingly, in the face of such wage pressures, almost half of property companies admitted to struggling to keep up with staff demands for, and expectations of, pay rises.

However, the 4.7% rise marked an easing in the pace of wage growth within the industry, down from the 5.0% recorded in both the March and October 2023 surveys. While modest, it may signal a turning point in the battle to keep remuneration budgets in check.

Easing skills shortages

Coinciding with stabilising remuneration increases is the continued easing of skills shortages. Companies across the industry have struggled in recent years to attract and retain skilled workers. Indeed, the most recent survey showed that a quarter of firms continue to face recruitment difficulties. It is noteworthy that this figure has continued to track downwards since peaking at 60% of companies in March 2022.

Changing face of work

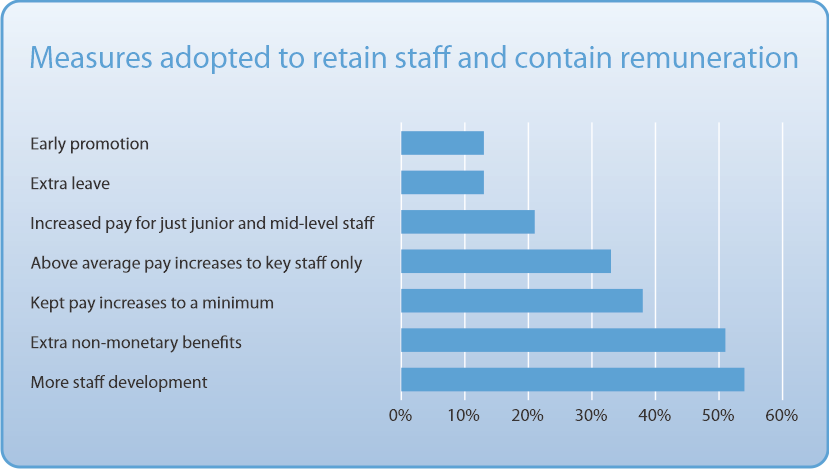

In a bid to both keep a lid on pay and attract new talent, property companies are increasingly seeking to embrace alternative means of rewarding staff.

Chief among these are greater staff development opportunities and extra non-monetary benefits, which have been introduced or expanded by more than half of the companies surveyed.

Hybrid working has also become the dominant nature of work for most companies, with the form it takes across the working week of four days in the office and one day at home becoming fairly standardised across the industry. Just 5% of companies label their current working arrangements as transitional, and only 25% of property firms have returned to pre-pandemic ways of working.

Also under the spotlight are employee performance reviews. Almost all companies said they already have, or are planning to implement, a formal performance review process. Yet there are notable limitations on the effectiveness of existing reviews, with just 40% of companies stating current processes are successful in achieving their objectives.

The future of property

Several factors will likely determine whether the current performance slump for property businesses is a blip on the radar or the start of a more sustained downturn.

Remuneration demands by staff have significantly weighed on growth, yet as previously noted, have eased slightly in the most recent survey and company expectations are that the remuneration increase planned for the coming months will be lower than 2023, suggesting a sustained moderation of pay growth.

Aiding this stabilisation will be the continued downward trend in the number of companies grappling with skills shortages, down from 60% to 25% over the past two years.

With anticipation that official interest rates have not only peaked but will begin to fall by year’s end, as well as ongoing efforts to implement efficiencies and positive operational changes internally, there is cause for optimism for property heading into 2024 and beyond.

We look forward to keeping you informed about the latest developments in the property industry. Stay tuned for more updates and analysis in our next newsletter.

More detailed analysis and sector-specific breakdowns of the data and trends are available in the new 2024 38th edition of the Avdiev Property Industry Remuneration Report . For those navigating the fast-paced world of remuneration planning, we offer tailored benchmarking and competitor analysis reports to assist you. Please contact me at debra@avdievreport.com.au or call 0492 974 041 for a discussion.