Property companies performing well and optimistic about the future

Rising costs, staff shortages, and unstable international conditions are at the forefront of challenges facing property businesses, with a possible worldwide economic crisis and recession looming.

From our recent October Update survey, a majority of contributors reported they are doing well despite the current economic climate. Almost two-thirds noted they are faring well or very well, while just 3% said their business is doing badly.

With the day-to-day returning to normal and despite growing economic concerns, better times appear to be on the horizon for a quarter of businesses, and another 62% are expecting to be performing about the same in the next 12 months.

Wages still on the rise as chairs remain empty

Strong demand for workers, increasing staff shortages and rising inflation and market pay rates have seen continued wage growth in the property industry with organisations scrambling to protect talent and retain employees.

Our Update survey found that remuneration has grown by 4% overall in the property industry, outpacing the latest Wage Price Index increase of 2.6%.

It was noted in some property sectors that vacancies have continued to become extremely difficult to fill. Increased freedoms and the rollback in restrictions have seen an upturn in business activities. This has seen a huge demand for staff as companies recover and activities return to pre-Covid levels.

Key to this demand is that half of all businesses reported that they now have a higher headcount than 12 months ago. Very few reported that they have lower staff numbers than the previous year.

Over half of our respondents and for all property sectors, said that significant staff and skills shortages were present, resulting in increased pay, earlier promotions, training and development opportunities and increased defensive actions to keep staff.

Some organisations have made critical compromises to fill seats, many having had to compromise on the level of skills and experience to secure talent while also lifting pay.

Revolving chairs

With such high demand for staff and increased pay and better conditions on offer, the carrots that recruiters and employers are dangling have been too much for many to refuse.

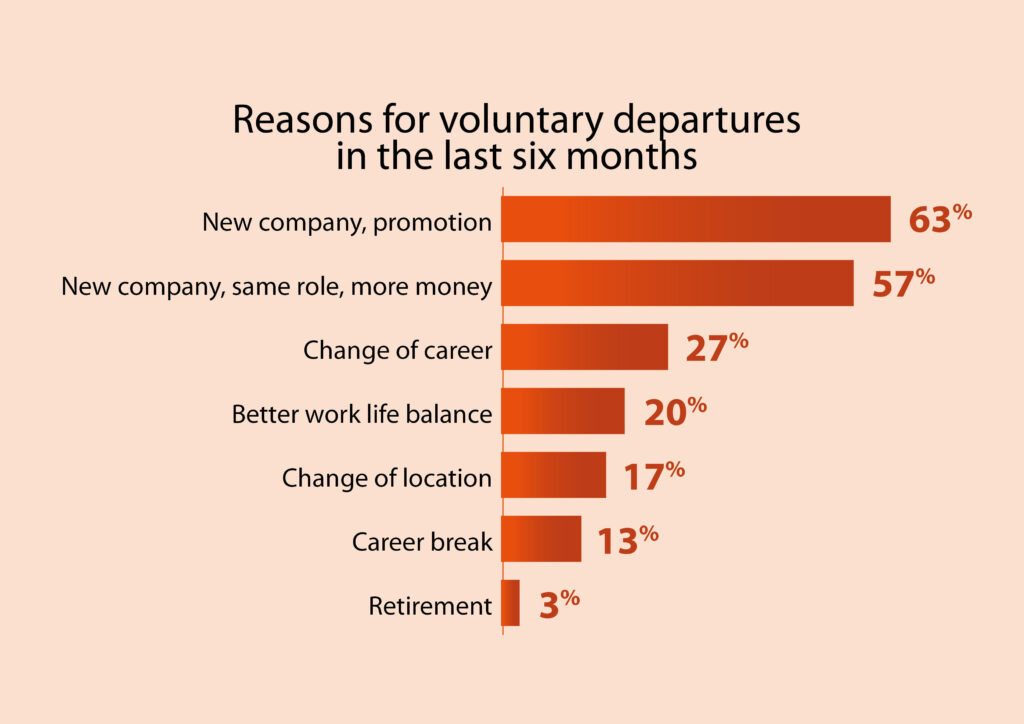

In the property industry, the main reasons for resignation were almost always for a move to a new company with a promotion, or even a move to a new company in the same role, but for more money.

Some are simply seeking a change of pace after the lengthy lockdowns and decide to resign to pursue other interests. This could involve switching careers or seeking a better work-life balance. We were told that Covid has seen a lot of personal reflection of work-life balance, particularly amongst the younger cohort. Many people are reflecting on their future in what is traditionally a very tough industry.

Work from Home is here to stay

The days of the 9-5 in the office are a thing of the past with more than 60% of property businesses now offering flexibility and hybrid working arrangements, in which the number of required days in the office per week were usually 3 to 4 days with 1 to 2 days at home. This model is now increasingly regarded as the “new way of working” as opposed to a transitional arrangement in the wake of COVID.

But this isn’t to say the pre covid working style is dead with a quarter of senior and mid-level staff opting to return to the workplace full-time.

This flexibility has enabled staff greater control over their workplace balance and in many cases has seen increased productivity and staff retention.

Over the pandemic, businesses were severely impacted by ongoing lockdowns and were challenged to pivot, evolve and embrace new working models. While the lockdowns and restrictions have lifted and business is returning to usual, turbulent global markets, staff shortages and growing wages are seen to be putting new pressures on organisations with empty chairs becoming more difficult and more costly to fill.

The data and observations are contained in our latest Avdiev Property Industry Remuneration Report 2022© October Update, the culmination of our extensive surveys about pay and business trends in the property industry.