Positive pointers for property industry

With the first interest rate cut in years now trickling through the economy and a federal election to be held within weeks, businesses are looking at how to optimise staffing levels and remuneration to position themselves for future growth.

Easing inflation, cost of living pressures and skills shortages are creating more favourable operating conditions for the property industry.

The Australian Bureau of Statistics (ABS) reported that annual CPI had fallen to 2.4% in the December 2024 quarter. Easing inflation saw the Reserve Bank cut interest rates in February for the first time since November 2020 – providing a boost in optimism for the property industry just as the autumn selling season begins, with longer term positive implications for construction costs and new development feasibility.

However, that doesn’t mean everything is rosy across the board for property businesses. While conditions may be improving in 2025, things remain patchy. Many sectors are still facing higher-than-usual expectations of remuneration increases from their staff, particular skillsets remain challenging to recruit for, and cost challenges continue to put pressure on budgets and impact the viability of new projects.

To keep a lid on costs and fully embrace the opportunities created by more favourable economic conditions, employers must understand how remuneration expectations within their own business compare with their sector and the wider industry.

Business conditions on the up

While the year was not without its challenges for the industry, 2024 marked something of a turning point for many businesses.

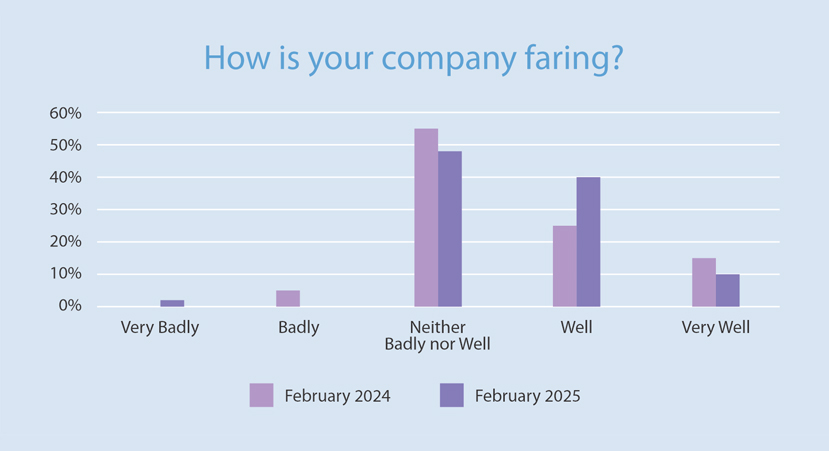

Half of all property businesses reported they are currently faring either well (40%) or very well (10%). When asked specifically how their current operating performance compared with 12 months ago, almost four in five companies (78%) said it was the same or better. This marked a substantial increase in performance from a year ago. Meanwhile, none reported doing badly.

This turnaround is expected to gather steam in the current year, with 46% of respondents anticipating their business to be better off in 12 months’ time and just 8% foresee a worsening in performance. The remainder anticipate maintaining a level footing.

Unsurprisingly, these expectations are tempered by the uncertainty surrounding the outcome of the impending federal election and whether further interest cuts will be forthcoming.

Meanwhile 28% of property firms continue to experience staff and skills shortages, with 69% suggesting these shortages are much the same compared with a year ago, while one in four (26%) reported a noticeable improvement.

Remuneration moderating

Our February 2025 survey found that wages growth in the property industry continues to outstrip the national figure but similarly has moderated over the past year.

Nationally, the Wage Price Index came in at 3.2% for year to the December 2024 – a rise of 0.7% for the quarter, which was the equal lowest quarterly rise since March 2022.

By comparison, the property industry showed remuneration growth averaging 4% – down from the 4.7% recorded a year ago. Increases varied across sectors and staff levels between 3.5% and 6.0%.

Looking ahead, remuneration freezes or reductions are nowhere to be seen, with all employers anticipating further increases this year. Again, there is considerable variability across sectors, although expectations overall are for an average increase of 4% – matching that of the past year.

Promising gender pay gap progress

While the Workplace Gender Equality Agency has the gender pay gap in Australia currently sitting at 21.8%, our survey shows the property industry making substantial inroads towards remuneration parity at all staff levels.

Some 60% of companies said they have implemented measures to address gender pay gaps and 24% reported an improvement at bridging this gap over the previous 12 months. None reported their progress going backwards.

Non-remuneration strategy successes

In the ongoing battle to attract and retain talent while carefully balancing tight budgets, employers are increasingly resorting to non-remuneration strategies such as staff development, mentoring, and flexible working arrangements. And, pleasingly for employers, these strategies appear to be working.

Over half said their non-remuneration strategies have proved successful (46%) or very successful (13%), while one-third pointed to medium success rates. Just 8% of respondents reported their strategies had failed to live up to their expectations.