Performance Improving, Pay Budgets Under Pressure

In recent months, the Australian property industry has experienced a number of challenges, with encouraging signs of business performance improvement, but significant challenges in managing pay budgets.

Economic Challenges Affecting the Property Sector

According to the latest update to the Avdiev Property Industry Remuneration Report®, inflation, interest rates, and rising costs remain the most pressing concerns for property companies over the past six months. High interest rates, in particular, have driven up the cost of borrowing, putting pressure on margins and profitability across most sectors of the property industry. Additionally, escalating material and insurance costs have further complicated efforts related to new developments, construction, and refurbishments. Compounding these challenges is the cautious approach investors are taking towards capital investment. Although attractive opportunities exist, many investors are hesitant to commit funds due to concerns about the economic outlook.

Managing Remuneration Budgets in a Tough Climate

Alongside these economic challenges, managing remuneration budgets has emerged as a top concern for property companies. Staff shortages, rising salary expectations, and the pressure to retain skilled employees have all impacted remuneration strategies. However, companies have reported some improvement in staff retention over the last year, though retaining skilled talent remains a continuing challenge, especially as they balance high workloads with maintaining necessary staffing levels.

Business Performance and Outlook

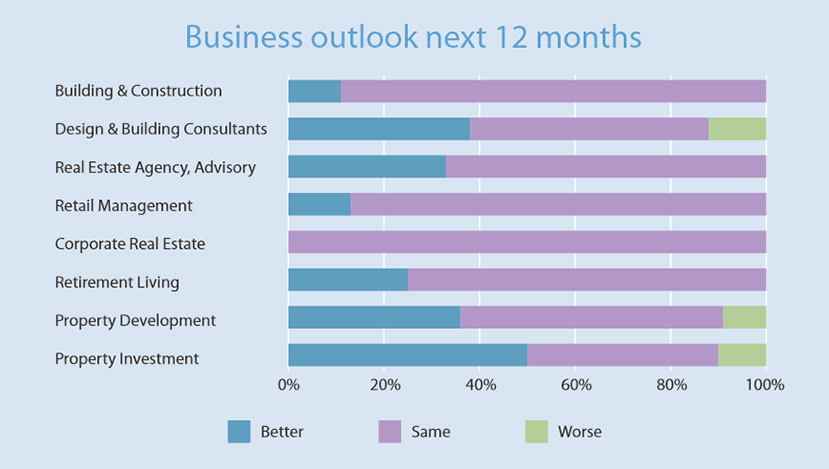

Despite the challenges, many property companies are reporting stable or improving business performance. Nearly half of the respondents to our survey indicated that their company is doing “well” or “very well”. Looking ahead, the outlook is generally positive, with one third of companies expecting to perform better over the next 12 months. To adapt to ongoing economic challenges, 40% of companies have revised their business strategies. The strategic changes range from reducing costs and staff, to expanding into new services and targeting new development locations.

Remuneration and Reward: Navigating a Fine Line

Cost-of-living pressures have been a key factor driving remuneration increases in the year to September 2024. Employees have sought higher pay to cope with rising costs, and employers have responded by balancing wage increases with the need to retain staff in a competitive market.

The median remuneration increase across all property sectors was 4.3% for the year to September 2024, slightly down from the 5% reported in September 2023. This increase is just above the economy-wide wage growth of 4.1%, as measured by the June 2024 Wage Price Index, and exceeds the 3.8% Consumer Price Index for the same period.

While almost two thirds of companies gave their usual full increase, one quarter awarded only minimal increases. Notably, nearly a third of companies received more pay rise requests than usual, predominantly driven by cost-of-living concerns.

Evolving Working Conditions

Recruiting skilled staff remains an ongoing issue, with one-third of companies reporting difficulty in filling positions. Sectors such as Real Estate Agency and Advisory, Design and Building Consultants, and Building and Construction have been particularly affected. However, staff shortages have eased slightly over the past year.

In response to shifting work dynamics, companies are grappling with the balance between hybrid work arrangements and maintaining productivity. While some organizations report ongoing challenges, others have successfully adapted to new policies.

Changes in psychosocial hazard regulations, gender pay gap reporting, and the right to disconnect have had a relatively low impact on most companies. Many organizations proactively prepared for these shifts, ensuring minimal disruption to operations.

Looking Ahead

The property industry faces a complex landscape of both opportunity and challenge. While business performance is improving, companies must continue to navigate economic pressures, rising costs, and remuneration challenges. Maintaining a balance between competitive pay, cost management, and staff retention will be key to thriving in the months ahead.