Property industry faces a challenging 2023

The next year will be another challenging one for the property industry as Australia experiences the fallout from ten consecutive Reserve Bank (RBA) interest rate hikes.

Our recent survey shows that 2022 was another year of strong wage growth, as pay rates climbed by an average of 5% in the property industry overall, the highest annual growth since 2007, outstripping the 3.6% average wage rise in the broader economy.

Companies report that they expect to continue these relatively high pay rises in 2023.

Inflation up, unemployment down

Mean inflation rose to 6.9% in the 12 months to December 2022, and during 2023 while inflation shows signs of slowing, the RBA forecasts inflation at 6.2% mid-year dropping to around 4.3% in December 2023.

Australia’s unemployment fell to 3.5% in February 2023, and businesses are feeling the pinch as vacancies become harder to fill, pushing wage expectations higher; that’s not going to ease much during 2023, despite strong net migration figures, with unemployment expected to sit around 3.8% by December 2023.

Avdiev Report’s survey of contributors, subscribers and supporters reveals 60% of respondents face skills or staff shortages, with many using higher pay to attract and retain workers.

Industry response: times are tough

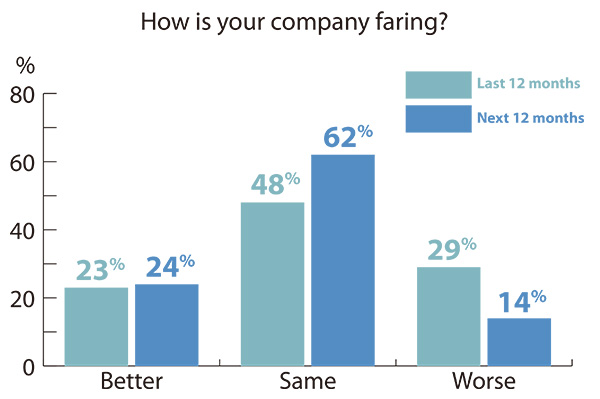

The current business climate hit property companies hard last year, with 29% reporting that 2022 was worse for business than 2021 – and our survey shows that 14% of property businesses expect the decline to continue during 2023.

Just 16% of property companies surveyed reported doing ‘very well’, while 39% said they were doing ‘well’ in the current climate; a further 39% rated their performance as ‘neutral ’ and 6% said their business is doing ‘badly ’ or ‘very badly’.

Looking ahead, less than a quarter (24%) of respondents anticipate the outlook for their businesses over the next 12 months is ‘better,’ – with retail management the standout, expecting a stronger year as we settle into post-pandemic conditions.

More than half (62%) of those surveyed said they expect their business to perform ‘much the same’, while a further 14% are gloomy, predicting a worse business outlook in 2023.

Salaries on the rise again in 2023

Pay rises climbed significantly last year with a median pay rise across the industry of 5% in 2022. Participants report that their pay increase decisions were heavily influenced by market conditions and staff shortages across the industry.

Most sectors anticipate ongoing wage pressures and around 60% of property businesses plan to award the ‘usual’ full increase in 2023 remuneration reviews.

Forecast high inflation, low unemployment and ongoing staff challenges will see 30% of roles receiving rises of 6% and above during 2023, while for 70% of roles, our survey responses found planned 2023 pay increase will be 1- 5%.

There will be far fewer catch-up payments in 2023 (only 10% of businesses plan a catch-up increase), more businesses expect to be awarding a minimal increase, and a small number report that a wage freeze may be on the cards – and comments suggest that bonus schemes may be a preferred option for some.

With the industry continuing to experience serious staff shortages, and a tight domestic labour market more generally, businesses are challenged by – on one hand, hanging on to valued staff; and on the other hand, remaining competitive when quoting for future work.

There is pressure to control overheads (including pay) so that costs don’t outstrip profits.

The highly cyclical property industry is better equipped than most to adapt to altered circumstances. Our survey shows the industry has creative, practical strategies in play to weather the tough economic climate we face over the next 12 months.