March 2021 Update

Looking to the future with cautious optimism

March 2021 Update

Looking to the future with cautious optimism

Australia is continuing to emerge from the long shadow of COVID-19. The vaccine rollout is underway, and the economy is showing encouraging signs of strength.

In February 2021, Avdiev Report surveyed our subscribers and supporters, just as the first doses of the vaccine were being delivered across the country and aged care residents and essential workers began receiving their first jabs.

The survey revealed a property sector poised for recovery. The difficulty of the past 12 months is evident, but the results reveal how quickly and effectively property businesses adapted and suggests they are now looking to the future with cautious optimism.

The Australian economy is returning to growth, thanks to our successful containment of COVID-19 and the government’s record levels of economic assistance. Our economy grew 3.1% in the December quarter, on the back of a 3.4% gain the previous quarter, the first time growth has exceeded 3.0% in two consecutive quarters.

Unemployment is back to 5.8%, which is a far cry from the 10% rate some predicted at the height of the COVID-19 crisis. Consumers are at the helm of the economic recovery, with retail spending up 11% in January compared with January 2020, showing not only the pace of recovery, but also the impact of the bushfires at the beginning of last year.

The property market is also picking up.

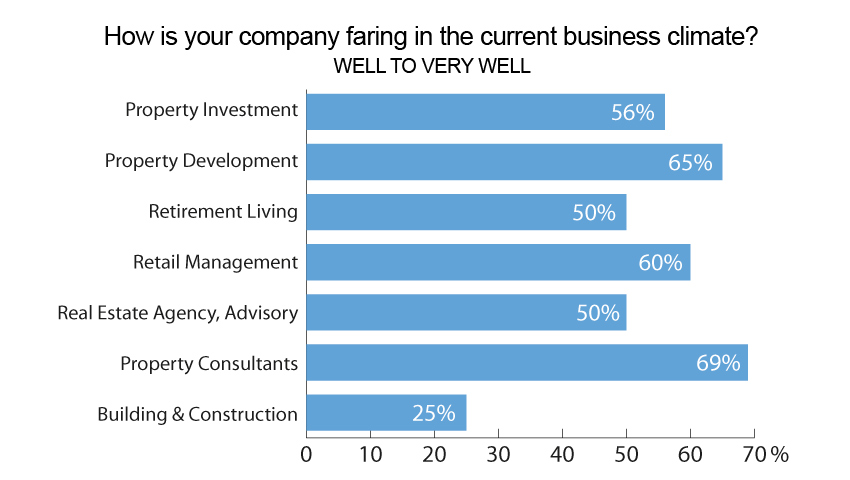

Business conditions in the property market

The property investment sector has experienced mixed results. The industrial sector is booming, with strong growth in demand for warehouses and logistics facilities. The office market is facing a period of uncertainty, but rent relief has not created the heavy burden many feared. While some tenants are downsizing, others are requiring extra space to allow for social distancing.

Property developers have been buoyed by the strong recovery in residential housing, but the huge reduction in migration is weighing on the sector.

The government’s HomeBuilder and Build to Rent support remains for now, generating work for the construction sector. Commercial builders are being engaged for alterations of retailers, offices and hospitals to comply with new infection control measures. And large government infrastructure projects are generating work.

In the retirement living and aged care sector, the royal commission’s report did not provide a clear path forward, so the sector awaits the government’s response to provide clarity. Occupancy rates in aged care homes fell to decade lows last year, reflecting concerns about safety during the pandemic.

Real estate agencies are benefitting from the surprisingly strong recovery in the housing market. Stock on the market is still thin, but there is obviously still plenty of interest in real estate. Agents in regional centres are benefitting from the shift to working from home.

Retail managers have had to grapple with the shift to e-commerce, which has eroded both rents and values. Working from home has also meant people are shopping locally, rather than travelling to large centres. The end of JobKeeper could put further pressure on the retail sector, which will continue to face uncertainties in the year ahead.

Architects, planners, project managers and quantity surveyors have seen project cancellations and delays, and firms have had to look for cost savings. However, conditions are now returning to pre-COVID levels.

So, how is pay faring in the recovering property sector?

Another question mark hanging over the economy is slow wages growth.

Avdiev Report’s latest survey results reveal the property sector is recovering, remuneration reviews are resuming, and pay rises can be expected this year, although they are likely to be restrained. Predictions range from 1.5% up to 2.3% depending on the property sector.

The latest pay data and market intelligence is contained in the 2021 Avdiev Property Industry Remuneration Report. Visit our website for more information https://avdievreport.com.au/property-remuneration-report/ or see below to order your copy.

Most participants reported they will absorb the July increase in the superannuation guarantee into remuneration.

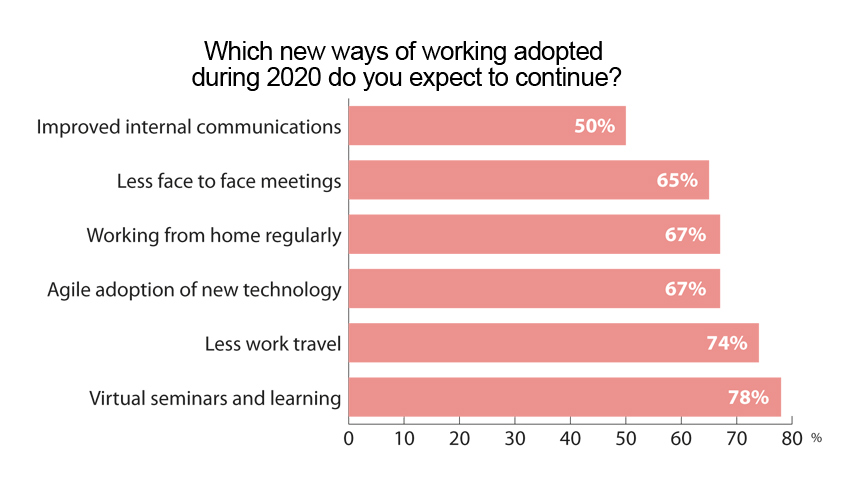

The responses showed the sector adapted rapidly to the dramatic changes in conditions during COVID-19 by reducing costs and diversifying. Businesses also went to great lengths to hold onto employees and provide a supportive work environment.

There were redundancies. One in five (21%) said headcount was lower now than 12 months ago. But roughly the same proportion (18%) said headcount was higher. Some businesses managed to create new positions, often filling gaps in expertise to help with diversification.

The surveys also confirmed what we all suspected, that working from home is here to stay.

The property industry is used to volatility, but last year was particularly rough. It’s encouraging to see signs of optimism out there.

We would like to thank those who shared their data with the Avdiev Report community and we hope our readers/members have enjoyed the insights we have been able to extract from the surveys. We will be in touch with members ahead of our next survey in September.